HootDex Institutional

Secure decentralized crypto-native solutions for Institutional Traders, Financial Institutions, Private Wealth Managers and Fintech Companies.

Why Institutions choose HootDex

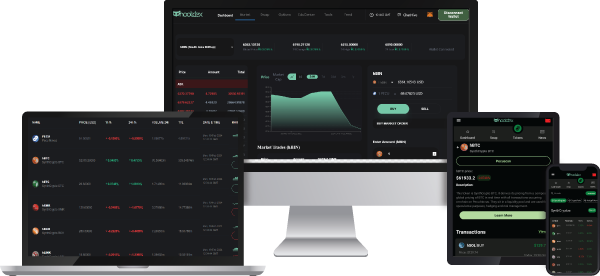

Unique products and comprehensive services

♦ Unique Tokens ♦ Low Trading Fees ♦ Liquidity Pool Staking ♦ Industry leading platforms ♦ Scalable REST/FIX APIs ♦ Limit & stop orders ♦ Custom token creation

Self Custody and Fast Onboarding

♦ Expedited verification process ♦ Self-custody of digital assets ♦ Simple onboarding ♦ In-system messaging support

Solutions for all Institutions

Institutional Traders

⊕ Solutions for hedge funds and asset managers

⊕ Self-custody of digital assets

⊕ REST/FIX API’s for integration into existing systems

⊕ Multiple sub-account support

⊕ Risk mitigation with unique HedgeTokens

⊕ On-chain transactions

⊕ Low fees

⊕ Data protection via Private layer-2 blockchain network

⊕ Tokenization of real world assets directly

⊕ Liquidity Pool staking for passive income generation

Private Wealth Managers

⊕ Portfolio diversification with unique digital assets

⊕ Self-custody of digital assets

⊕ Ability to escrow digital assets directly

⊕ REST/FIX API’s for integration into existing systems

⊕ On-chain transactions

⊕ Low fees

⊕ Data protection with a Private layer-2 blockchain network

⊕ Liquidity Pool staking for passive income generation

Financial Institutions

⊕ Expand offerings to include unique digital assets

⊕ Self-custody of digital assets

⊕ Ability to escrow digital assets directly

⊕ REST/FIX API’s for integration into existing or new systems

⊕ On-chain transactions

⊕ Low fees

⊕ Data protection with a Private layer-2 blockchain network

Solutions for all Institutions

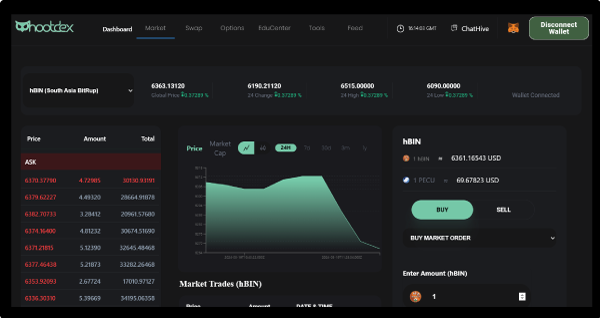

HootDex Decentralized Swapping

Crypto-native industry leading technology for institutions

Features:

They include real-time pricing & leveraging tools, HedgeTokens for risk mitigation and management, robust account management & trader assigned accounts, REST/FIX APIs for easy implementation into existing institutional trading systems.

Self-Custody Safekeeping

Cold in-wallet or offline cold storage for institutions

Features:

They include self custody of digital assets for institutions and their clients, MVault integration for in-wallet or offline cold storage, access to decentralized liquidity pool staking, creation & escrow system for digital assets on HootDex , access to NFT creation, self-custody & bundling monetization.

HootDex OTC Desk

Deep liquidity and low impact for large institutional crypto orders

Features:

They include deep digital asset liquidity for institutions and their clients, ability to transfer large blocks of digital assets with little market impact, access to REST/FIX APIs or use our interface for block trades, access to intraday credit for leveraged trading for maximum efficiency of capital deployment.

Token Creation

Institutions can create custom tokens and liquidity pools

Features:

They include the ability to create custom tokens that may represent a basket of digital assets of a fund in a Digital Basket Token, pricing from a specific digital asset in a SynthCrypto or CryptoPair or representing a venture project in a Venture Token.

Got Questions? We have Answers

What Digital Assets are Supported for Swapping on HootDex?

HootDex is specific to tokens created on the Pecu Novus blockchain, so Institutions will be able to swap any digital asset listed on HootDex such as SynthoCryptos, CryptoPairs, Venture Tokens, Digital Basket Tokens “DBTs”, Stablecoins, ,FanTokens and PECU itself.

When they become available then the integration of a stable coin or stable coins will also be included in that list.

I'm a Private Trader, Can I Use The Institutional Tools?

Unfortunately No, Institutional Swapping tools are specifically designed for confirmed financial institutions. However retail tools for professional private traders will be available in the near future.

Is HootDex Free to Use for Institutions?

The answer is Yes

The Institutional tools that will be offered will include Prime REST API for order placement and historical data, FIX API for High Frequency Trading/Swapping and Prime Websocket Feed for real time market data.

How Do We Request Institutional API Keys?

We will be opening up registrations once the development of the tools are completed. We will post updates.

Do We Need To Fully Fund Our Wallet?

The answer is No.

HootDex will be providing institutions with a lending protocol to leverage their PECU coins to maximize their swapping ability.

Can We Use Bitcoin, Ethereum, Litecoin and Solana to Onboard?

The answer is Yes.

There will be a one way bridges that will support the onboarding of Bitcoin, Ethereum, Litecoin and Solana to swap into PECU coins for swapping on HootDex.

Can Insitutiions Request Their Own Tokens or Custom Tokens?

The answer is Yes.

At no cost to the Verified Institution, they can request to have a custom token created on the Pecu Novus blockchain to represent certain digital assets, other assets as a pair or even a basket different tokens. It is the responsibility of the institution to comply with any regulatory requirements and it is also their responsibility to be the liquidity provider for that specific liquidity pool.

Does HootDex Provide Custody Services?

The answer is No.

HootDex is a decentralized digital asset swapping system and as such all members, private traders and institutional level members are their own custodians.

Will There Be a Limit Per Trading Day?

The answer is No.

As digital assets swap 24/7/365 there can be no limit to the level of trading , the only limits have to do with the capacity of your wallet and the lending protocol in place.

How Does HootDex Handle Customer Support and Issue Resolution?

Institutions will have a representative in place to work with.

What Security Measures Does HootDex Have in Place To Protect Our Digital Assets?

HootDex is a decentralized swapping system and as such it does not control any members digital wallet at any time. There are intricate security protocols in place that protect members as they are on HootDex. It is highly advised that members keep their digital wallets as safe as they do their traditional bank accounts.

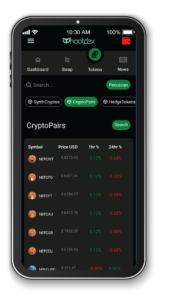

Does HootDex Offer a Mobile App For Institutional Trading on The Go?

The answer is No.

Institutions have a specific set of tools that they will use on the backend for development or integration into other systems.

Does HootDex Offer Margin Trading & Other Advanced Trading Features for Institutions?

The answer is Yes.

Institutions will have a specific set of tools that they will use on the backend for development or integration into other systems. Other tools will be released as they come out of beta mode.

Institutions will have access to a protocol that will allow them to leverage their PECU to maximize their daily trading ability at very minimal cost.

Can an Institution Integrate HootDex into its Current Trading Systems?

The answer is Yes

The Institutional tools that will be offered will include Prime REST API for order placement and historical data, FIX API for High Frequency Trading/Swapping and Prime Websocket Feed for real time market data.

Are There Any Special Incentives or Promotions for Institutional Traders?

Institutional traders enjoy zero gas fees, on-chain swaps, self custody, leveraged trading and very low transactional fees.

Institutional trading firms also have the ability to request custom tokens for digital asset baskets.

Are These Any Restrictions or Limitations Based on an Institutions Geographic Location?

HootDex is a decentralized swapping system and as such it does no provide custody services, PECU and token holders are in full control of their wallet at all times. With that said HootDex has not imposed any restrictions as it relates to geographic location unless it is in violation of international laws or regulations.

r.

What Documents and Information Are Required For Verification and Compliance?

HootDex is a decentralized swapping system but still has a vetting process to make sure that an institution is a genuine institution. In the near future the MegaHoot Digital Identity System will be in place that would be used in order for compliance to be in place for AML/KYC laws internationally. This adds additional measures in protecting all HootDex members from fraud and bad actors.

What Are The Swapping Fees and Gas Fees Charged by HootDex?

HootDex is a decentralized swapping system and utilizes liquidity pools to create an automated market maker environment. All swapping fees take place in each individual pool, the swapping fees equal to a maximum of .0025% (1/4 of 1%) per completed swap. Institutions, depending on their activity, enjoy greatly reduced fees on most liquidity pools.

HootDex absorbs all Pecu Novus blockchain gas fees.

There are no onboarding fees.

How Does The Order Placement and Execution Process Work on HootDex?

This is pretty simple, automated market makers create the bid and ask for any token.

Market orders do execute at market prices on HootDex and onchain.

Limit orders are all Good Until Cancelled, they will execute at the limit price set by the institution. High Frequency Trading uses limit orders in a rapid fire environment but follow similar protocols. Such trading is dependent on the system that the institution may use.

What Are The Available Order Types and How Do They Function?

Order types available on HootDex include Market Orders, Limit Orders and Stop-Loss Orders.

How Can an Institution Swap Digital Assets or Funds To Swap On HootDex?